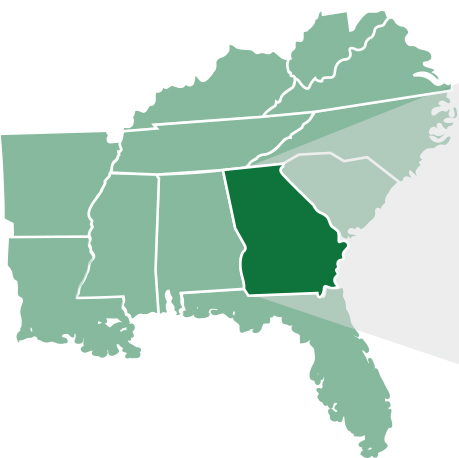

Franklin County Incentives are Many and Costs are Low

Tax exemptions, fee waivers and property tax abatements are some of the incentives that make the cost of doing business low in Franklin County, Georgia. Additionally, a wage rate lower than the U.S. average keeps business costs in check.Annual Wage Comparison

-

Southeast $61,186

-

Georgia $67,652

-

Franklin County $46,020

Annual Wage

Comparison by Industry

| Franklin County | Georgia | Southeast | |

|---|---|---|---|

| Manufacturing | $57,616 | $56,628 | $74,619 |

| Transportation & Warehousing | $54,860 | $52,572 | $73,730 |

| Retail | $36,348 | $30,940 | $40,314 |

| Healthcare & Social Assistance | $48,516 | $49,608 | $58,569 |

| Accommodations & Food Service | $18,928 | $20,592 | $36,504 |

Freeport Tax

100% exemption on raw materials, goods in process or manufacture and finished goods destined for shipment out of state.

Corporate Income Tax

In Georgia is 5.39%.

Single-factor apportionment treats a company’s gross receipts, or sales in Georgia, as the only relevant factor in determining the portion of that company’s income subject to the state corporate income tax rate.

Sales Tax

Franklin County’s sales tax rate is 7%:

- 4% State

- 1% Local Option Sales Tax

- 1% Local E-SPLOST

- (Education Special Purpose Local Option Sales Tax)

- 1% Local SPLOST

- (Special Purpose Local Option Sales Tax)

Hotel/Motel Tax

Overnight visitors to Franklin County will pay sales tax and Hotel/Motel Tax.

- Franklin County: 5%

- City of Franklin Springs: 3%

- City of Lavonia: 8%

- City of Royston: 3%

Property Taxes

(per $1,000 of Fair Market Value)Real and personal property in Franklin County is assessed on 40 percent (%) fair market value (FMV). The assessed value is then multiplied by the total mill rate for the jurisdiction to calculate the tax bill.

- Sample Tax Calculation: $1,000 FMV x 40% = $400

- Using unincorporated Franklin County+ Schools+Development Authority:

$400 x .027931 = $11.17 per $1,000

Millage Rate

| City of Canon | 0.000 |

| City of Carnesville | 1.460 |

| City of Franklin Springs | 5.000 |

| City of Lavonia | 8.750 |

| City of Royston | 8.947 |

| County – Incorporated | 9.663 |

| County – Unincorporated | 9.082 |

| Development Authority | 0.250 |

| Franklin County Schools | 14.471 |